The Paul B Insurance Local Medicare Agent Huntington PDFs

Table of ContentsThe Only Guide to Paul B Insurance Medicare Insurance Program HuntingtonThe Best Strategy To Use For Paul B Insurance Medicare Agent HuntingtonHow Paul B Insurance Local Medicare Agent Huntington can Save You Time, Stress, and Money.Facts About Paul B Insurance Medicare Part D Huntington UncoveredPaul B Insurance Medicare Agent Huntington Can Be Fun For Anyone

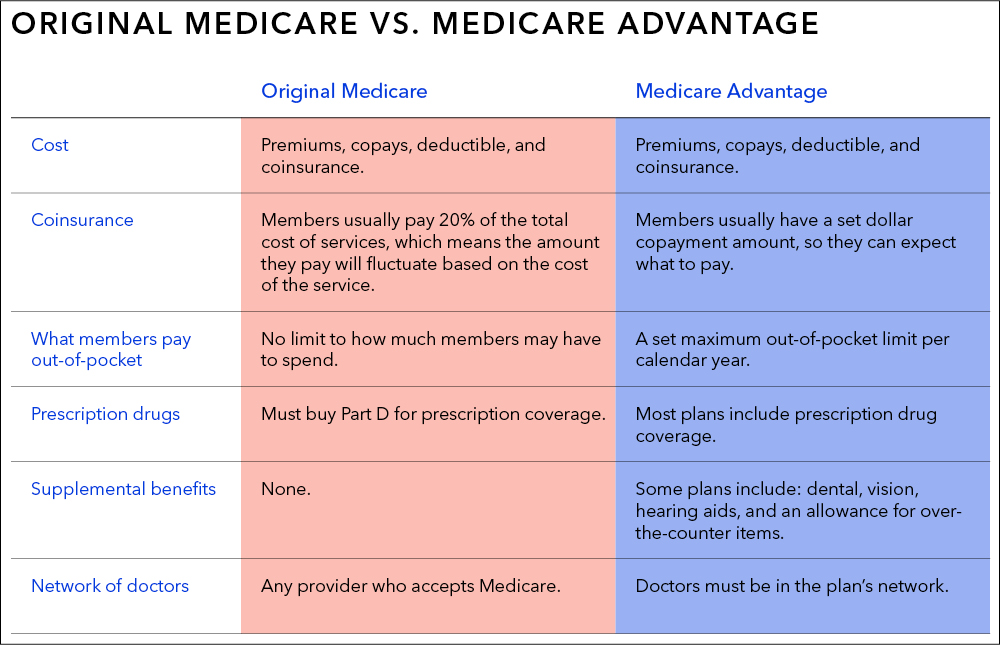

A: Initial Medicare, also recognized as traditional Medicare, consists of Part An and also Part B. It enables recipients to go to any doctor or medical facility that approves Medicare, anywhere in the United States.You are covered for as much as 100 days each benefit duration if you get insurance coverage. To qualify, you need to have invested a minimum of three successive days as a hospital inpatient within 30 days of admission to the SNF, and also need competent nursing or therapy services. House healthcare: Medicare covers solutions in your residence if you are homebound and require experienced treatment.

To receive Part A coverage, you must have invested a minimum of 3 consecutive days as a hospital inpatient within 14 days of receiving home healthcare. Hospice treatment: This is care you may elect to get if a provider establishes you are terminally ill. You are covered for as long as your company accredits you need treatment.

The majority of people do not pay a regular monthly Part A premium since they or a partner have 40 or even more quarters of Medicare-covered employment (paul b insurance medicare agency huntington). In 2023, if a person has less than 30 quarters of Medicare-covered work the Part A costs is $506 monthly. If a person has 30 to 39 quarters of Medicare-covered employment, the Part A costs is $278 monthly.

6 Easy Facts About Paul B Insurance Medicare Advantage Plans Huntington Shown

Long lasting medical equipment (DME): This is devices that offers a clinical objective, is able to endure repeated use, and also is appropriate for use in the house. Instances consist of walkers, wheelchairs, and also oxygen containers. You may purchase or rent out DME from a Medicare-approved supplier after your supplier accredits you require it.

Treatment services: These are outpatient physical, speech, as well as work treatment services given by a Medicare-certified therapist. Chiropractic treatment when adjustment of the spine is medically necessary to deal with a subluxation of the spine (when one or even more of the bones of the spine action out of placement).

Facts About Paul B Insurance Medicare Advantage Agent Huntington Revealed

Various type like this of Medicare Benefit Plans are offered. You may pay a monthly premium for this insurance coverage, in enhancement to your Part B costs. If you sign up with a Medicare Advantage Strategy, you will certainly not utilize the red, white, and blue Medicare card when you go to the doctor or hospital.

These plans may cover impressive deductibles, coinsurance, and copayments as well as might additionally cover health and wellness treatment costs that Medicare does not cover at all, like care obtained when traveling abroad. Bear In Mind, Medicare Supplement Program just collaborate with Initial Medicare. If you have a Medicare Benefit Plan, you can deny a Medicare Supplement Plan.

Each policy uses a various collection of standardized benefits, indicating that plans with the same letter name supply the same benefits. There you'll discover more information regarding means to prepare for Medicare, when and how you require to enroll, what to do if you plan on functioning past age 65, choices to supplement Medicare, as well as resources for additional details as well as aid.

The Buzz on Paul B Insurance Medicare Insurance Program Huntington

It is occasionally called Conventional Medicare or Fee-for-Service (FFS) Medicare. Under Initial Medicare, the federal government pays directly for the health and wellness care services you get. You can see any physician and also health center that takes Medicare (and most do) throughout the nation. In Initial Medicare: You go directly to the doctor or health center when you need treatment.

It is necessary to recognize your Medicare protection choices and to pick your coverage very carefully. Exactly how you choose to get your benefits and that you obtain them from can affect your out-of-pocket costs and where you can obtain your treatment. his explanation In Original Medicare, you are covered to go to nearly all doctors as well as hospitals in the nation.

Nonetheless, Medicare Benefit Program can additionally give fringe benefits that Original Medicare does not cover, such as routine vision or dental treatment.

These strategies are offered by insurer, not the government government., you have to also get Medicare Components An and also B. You can check out the chart over for a refresher on eligibility. Medicare Advantage plans additionally have certain service locations they can supply coverage in. These service areas are licensed by the state as well as try these out approved by Medicare.

Everything about Paul B Insurance Medicare Agent Huntington

Most insurance strategies have a site where you can inspect if your doctors are in-network. You can additionally call the insurance provider or your doctor. When determining what alternatives best fit your budget, ask on your own how much you spent on health treatment in 2014. Maintain this number in mind while examining your various strategy options.